Drip pricing: what to do about the Digital Markets Competition and Consumer Bill today

Tim explores the new regulation on drip pricing.

The need for new regulation on drip pricing

Legislation protects customers, promotes ethical trading and mandates change. The Digital Markets Competition and Consumers (DMCC) Bill sets out to do exactly that. It involves a ban on fake online reviews and changes to the display of pricing information including hidden fees and dripped prices. Here we’ll focus on drip pricing.

Current legislation at this pace is vague, old and almost impossible to enforce. In January 2024, drip pricing was added to The Digital Markets, Competition and Consumer Bill to provide a more specific, robust and unequivocal set of legally-binding rules. While the full details of the bill are not known, the Department for Business and Trade says, “Sneaky hidden fees, or dripped prices that are unavoidable will be banned.”

Changes to drip pricing need to be paid attention to, as they impact the bottom line directly. They are especially pertinent to the owners of digital experiences as they require businesses to think hard about pricing models, the strategy behind them and the execution of them through design and experimentation. In fact, there’s not many digital teams it won’t impact.

Drip pricing: a quick sketch

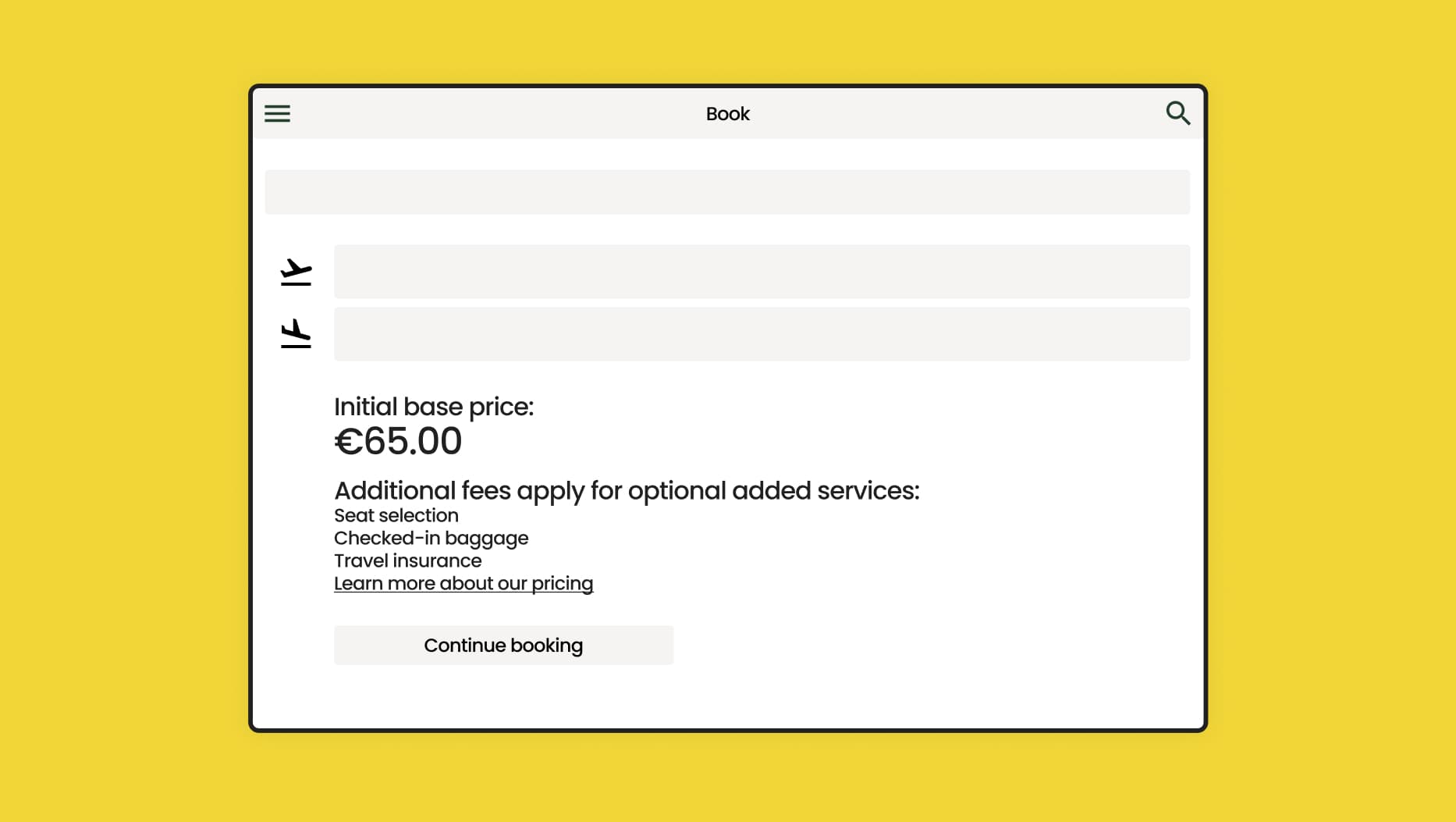

We've all been there. You find a cheap flight on Skyscanner and everything looks good.

You can't believe you’ve found your ideal flight for that price!

You navigate to the airline’s website to seal the deal. Hang on, it's more expensive there? Ah well, it's still cheap, let's go for it.

Do I want to choose a seat? Well, yeah that would be nice. Oh, that's 30 quid.

Of course I'm bringing cabin luggage. I'm going on holiday. £37?

This is getting a bit silly now…

Oh, you also recommend insurance? For £30?

Offset my carbon for £12.50?

And so on. That's drip pricing…

What is drip pricing in plain English?

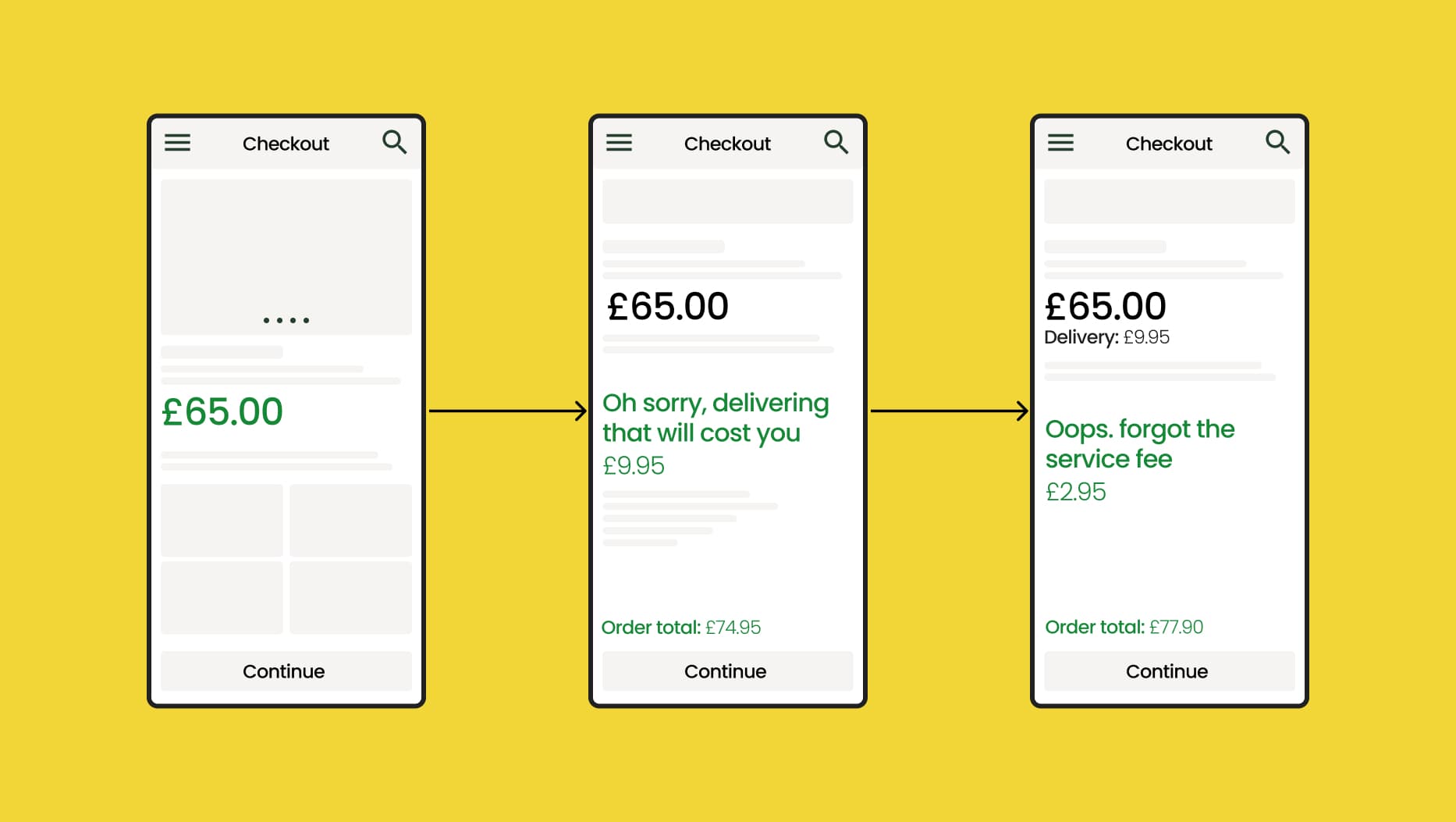

Drip pricing is where additional charges are added progressively to an initial price making it more expensive. It's estimated that drip pricing costs UK consumers around £2.2 billion each year. On average, that means people pay around 6% more than the base price they thought they’d pay.

It will also impact a lot of businesses. In a study by Alma Economic for the UK Department of Business and Trade, almost 50% of product retailers and service providers surveyed had at least one dripped fee in their checkout process. Not only that, but dripped fees considered harmful, like mandatory fees that make the base price unattainable, were present in 41% of the checkouts surveyed. Typically, the addition of these fees happens at a point in which people have already gone through a reasonable amount of effort to make a decision about a purchase.

With that said do customers care about, or even perceive, drip pricing, or do they just think they're getting a good deal? The answer is it depends on a lot of individual factors, sensitivity to price and general awareness or acceptance of this pattern. Despite that, clearly it matters enough to the government for a new bill to be written and passed.

How to recognise dripped fees

The most common dripped fees fall into specific types depending on the industry.

For retail, it’s commonly delivery fees, but additional product suggestions are another way retailers hope to extract additional revenue. People may want to buy an additional product, but if these additional products are preselected or mandatory this falls into the category of drip pricing.

When compared to other forms of commerce, digital retail checkouts have limited scope for dripping fees. Transport, hospitality and entertainment have journeys with lots of steps and dependencies where drip pricing can happen.

Think luggage fees. Think seat reservation fees. Think insurance fees. Think service fees.

Clearly not all businesses are trying to drip prices in this way. It's perfectly fine to offer insurance with an airline ticket as long it’s done transparently, at the right time and in a way that helps people make an informed choice. What shouldn’t be happening is forcing consumers to decline pre-selected options, conveying scarcity, urgency or negative impact, or making the extra purchase mandatory when that need wasn’t stated earlier in the journey.

Sneaky hidden fees, or dripped prices that are unavoidable will be banned.

Why does drip pricing work?

Firstly, because of human behaviour, having gone through the journey of discovery, selection and into the purchase funnel many people are unlikely to want to start all over again. Secondly, these journeys also typically feature messaging that conveys a sense of immediacy or scarcity. Thirdly, it happens across experiences, it’s become a tacitly accepted part of purchase journeys by many people.

More specifically, here’s some tactics that keep people from abandoning the journey and paying dripped fees.

Anchoring and adjustment

People often anchor to the first price they see and fail to cognitively compensate for the extra fees being added. Usually because the fees are small enough to go unnoticed.

Foot in the door

People are more likely to agree to something if they’ve already taken small steps towards it. The initial price draws people in which makes them more likely to follow through with the final, higher price.

Sunk cost fallacy

It takes time and effort for people to find what they’re looking for. Once they’ve reached the point in a journey where additional costs are revealed people don't want to lose the time they’ve invested.

How does drip pricing impact consumers?

Although many people may not think twice about dripped fees the late introduction of fees psychologically commits consumers to purchases, making them more likely to proceed despite frustration with pricing information being withheld. When it comes to future purchases, they may be more sceptical based on prior experience and take longer to make a purchase.

As a knock-on effect, these feelings and experiences can reduce trust and drive negative brand perception. If someone does pull out of a journey it wastes their time and erodes their trust.

In sum, rather than driving higher basket value by gradually nudging up the price, drip pricing could contribute to greater cart abandonment and a reduction in customer lifetime value.

Legislation will impact business

The new legislation aims to combat low base prices that cannot be obtained due to incremental fees and add-ons, both compulsory and heavily implied. This change will have a significant impact across retail and service sectors. To comply with the new legislation, and avoid potentially damaging fines, businesses will have to alter their digital checkout experience and approach to articulate price and value to customers.

Improving journeys or moving add-ons to a different page is unlikely to be enough. It requires thinking about the design of core digital journeys and the business processes, pricing engines, marketing and fulfilment that supports them.

It will require operational expense to make these changes. But those who don’t want to risk fines and who do want to offer customers a better experience, without impacting conversion and revenue, need to think about how to respond in a way that meets business objectives and satisfies customers.

Don’t worry, regulation is a good thing

One way to look at it is that this change is just another way in which businesses can deliver against their commitments to better serving customers. It’s an opportunity for growth, if considered carefully.

This involves developing a digital strategy based on transparency, trust, and compliance, to ensure a positive customers relationship which can provide short- and long-term value. Particularly if this strategy is used as a platform to elevate the brand and experience together, meaning the business has a greater ability to command a higher price in the long run.

The Digital Markets, Competition and Consumer Bill isn’t about starting over, it’s about evolving what is there through the power of design, experimentation and content and testing it gradually to make sure customer experience and key performance metrics remain strong with a view of this bigger, overarching strategy.

What to do today to respond to the Digital Markets, Competition and Consumers Bill

The Digital Markets, Competition and Consumers Bill isn't likely to come into force until the second half of 2024 but the only way to ensure compliance is to act now. So, what can be done today?

The tactical things

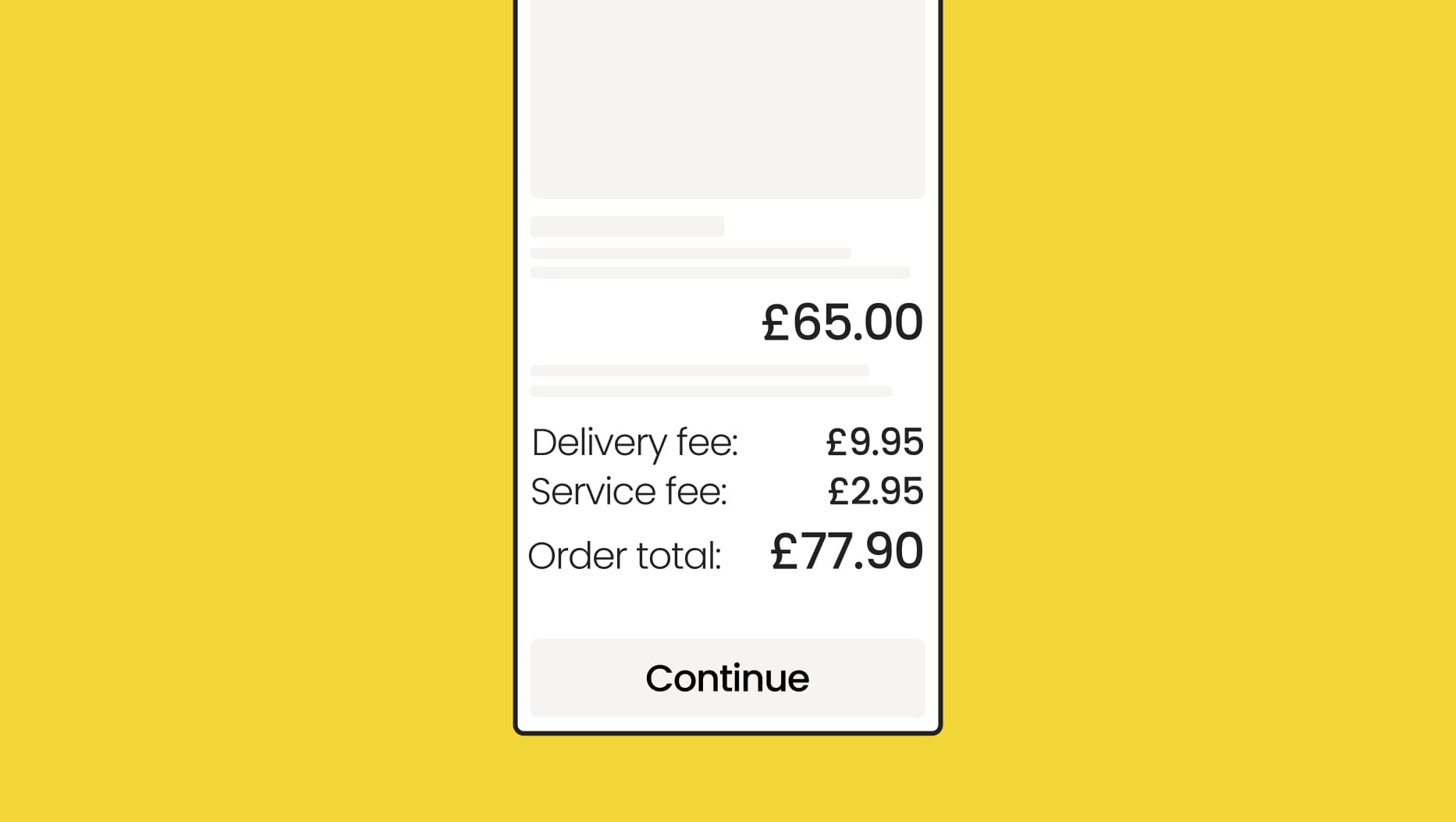

The legislation will focus on transparency in pricing - particularly the initial base price advertised - which means that to comply businesses will have to clearly state the total price, upfront, including any mandatory fees that may have previously been dripped in across the checkout process.

Think of it like the price breakdown shown at last stage of the checkout, but now it's the price breakdown at the first stage of the checkout. Price breakdown is the key phrase here. That’s base price, fixed fees, variables fees, service charges, shipping charges, admin fees and non-optional add-ons being clearly listed and conveyed at the start. Design and content can help businesses do this, but it requires careful consideration and testing.

One option could be to offer product bundling. That means showing upfront overall tiers and their prices. This is a common tactic that software as a service companies use to describe their products. This could allow consumers to understand their options and make informed choices before entering the purchase journey.

Another option is framing these products, options and add-ons as part of a tiered subscription model where consumers can easily evaluate the differences between subscription tiers through comparison.

Despite these suggestions, businesses need to step carefully. A response is only going to be devised cross functionality and not by design and engineering teams alone. This is because design and engineering cannot design how they remain competitive on base price alone. Finance, marketing and legal need to be involved in this cross functional team.

Low base prices aren’t bad, and won’t be bad going forwards, if they are part of an overall cost that consumers can easily evaluate from the get-go. And this is the crux of the matter. How does a brand redefine their competitive proposition based on transparent pricing? How are technology, experience and marketing working together to achieve this?

Focus on the value a business delivers

If it’s going to be harder to win on initial price then brands need to think hard about remaining competitive and leveraging that competitive edge in a joined-up way across touchpoints.

Essentially, how to balance transparency, trust and compliance while still maintaining healthy conversion rates, growing revenues and the ability to acquire new customers.

In this space, value pricing is perhaps the most important pricing strategy of all. What is a person willing to pay? And how is this influenced by the brand experience on offer, is it of quality, is it value adding?

To set value-based prices, companies must have a deep understanding of their target audience’s needs, pain points, and motivations, as well as the brand’s reputation. Businesses will also need to consider how the market changes how people perceive value and how that’s designed.

While we are highlighting value pricing, even if businesses don’t adopt it in full, they do need to consider it. It can help decrease risk by ensuring they don’t start with a price that’s too high or too low based on their customers.

Experimenting with price and how it’s conveyed is what is going to give a business the edge. Of course, experimenting with price and messaging across multiple variants also needs to be combined with deep studies of existing data and third-party data to validate any changes.

Minimum viable drip pricing changes

We’ve talked about various approaches to implementation, with varying degrees of complexity from straight-up transparency in the checkout process to value-based pricing models, but the most immediate, tactical and achievable implementation is based on the options considered in the Department for Business and Trade’s own impact assessment:

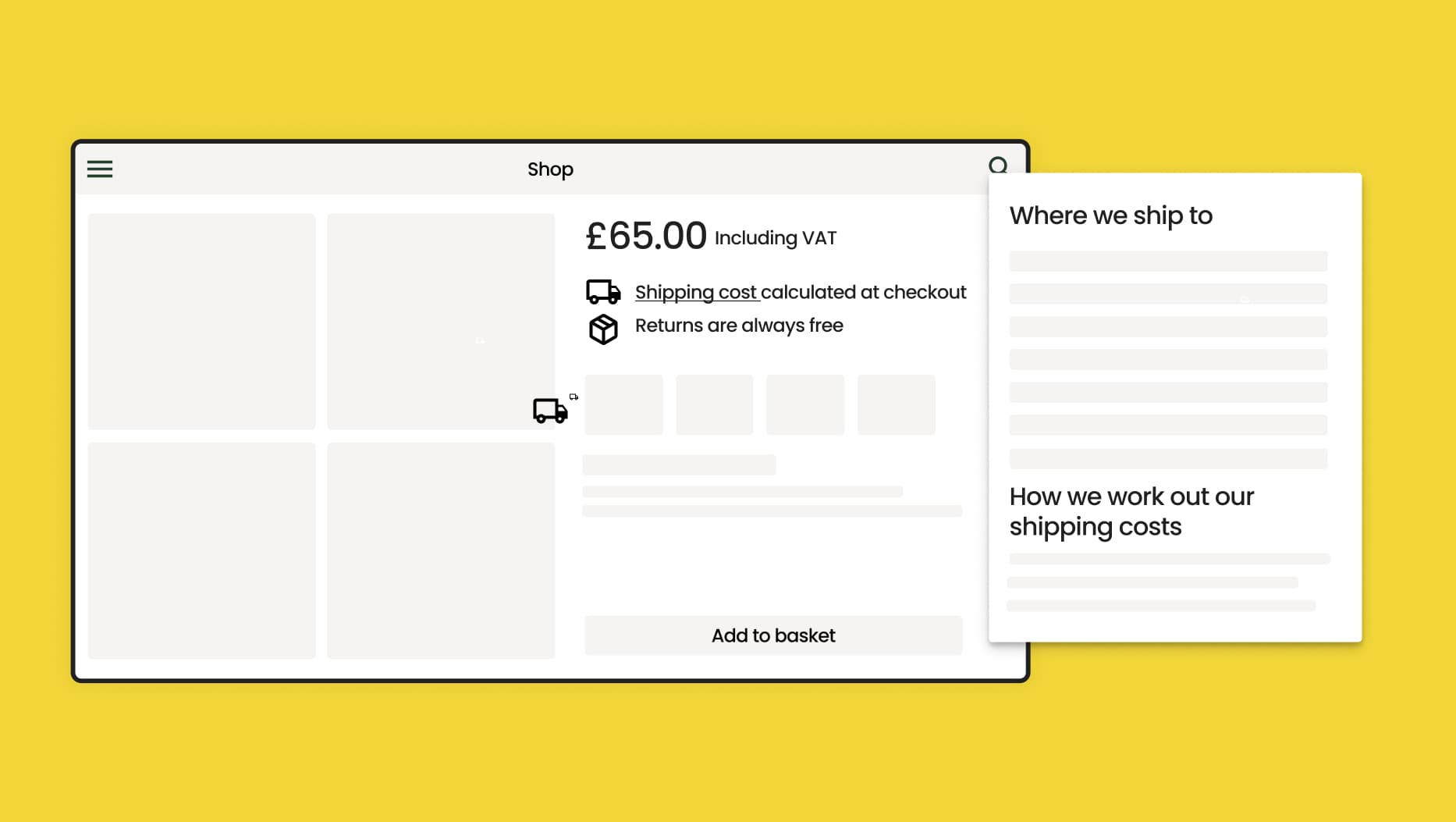

A requirement for businesses to include fixed mandatory fees in the price first displayed to consumers.

A requirement for businesses to make it clear that variable mandatory fees will be added to the purchase and how they would be calculated when the base price is first displayed to consumers.

A requirement for businesses to make clear that optional fees may be added to the price of a product when the price is first displayed to consumers.

The important thing about these options is that they enable businesses to comply with the legislation, but don’t necessarily require significant changes to the checkout process. Crucially, they also allow for experimentation, offering the ability to measure the impact on conversion and to test variants across journeys.

To respond to drip pricing at the most basic level, all a business is really required to do (after a necessary evaluation of what fees are really optional or mandatory) is provide clarity at step one of the checkout process, where the base price is first shown:

But some businesses might have variable mandatory fees which cannot be calculated at step one, such as shipping fees based on location. This is fine. The requirement here is to provide transparency at step one on what those fees are, and how they will be calculated. It might be as simple as just saying that they will be calculated later. It would be better to explain why they are calculated later. If shipping is included, even better say that. It’s all about transparency.

If there are optional fees which are only surfaced as part of a booking process, then being compliant means being transparent. Tell customers that booking a seat will have an extra cost. Tell customers that adding travel insurance will have an extra cost. And tell them that when they first see the base price.

Even these simple changes in the design and flow of checkouts will move businesses towards compliance and a more transparent relationship with customers.

Don’t worry, we can help

Changes to price and value need to be robust. Creating variants and testing and validating them before committing is critical.

The time before the changes come into force is the time for exploring, without destroying, the way pricing works in businesses today.

Taking this approach can establish an experimentation-led way of think about the future that can be validated over time with increasingly large data sets without jeopardising existing models and business metrics.