Navigating Consumer Duty: What insurance companies need to know

A look into ways to tackle the issues insurers are having with complying with Consumer Duty through insight, intelligent personas and experience design.

We’ve previously published thoughts on complying with Consumer Duty in which we examined the actions, impacts and long term issues providers will face in complying with Consumer Duty over time.

Since then, it’s become increasingly obvious that the insurance market is struggling more than most to come to terms with this regulatory shift.

So much so that special emphasis has been placed on this sector by the Financial Conduct Authority (FCA). A recent FCA publication, specifically addressing insurance, highlights the key issues in monitoring outcomes in insurance.

Overly process-focused approaches rather than outcome-driven monitoring.

Limited insight into actual customer outcomes in board or committee reporting.

Inadequate metrics and data analysis.

Poorly set or communicated thresholds and standards.

Lack of evidence showing proactive actions taken to improve outcomes.

Why has Consumer Duty been an issue for insurance?

Before wagging the finger at insurers, let’s take a look at how businesses in this sector work. Firstly, in many cases there are two sides to insurance. What seems to consumers to be a single entity, or brand, at the point of purchase can turn into a fragmented and sometimes disjointed collection of unknown brands at the point of claim. For example, your Post Office travel insurance may actually be underwritten by Legal & General - making who you talk to and who ultimately handles your claim unclear.

Insurers also often rely on third party suppliers offering claims handling - someone like Sedgwick - to manage the claims process, which can lead to disjointed customer experiences. This separation of responsibilities has resulted in a twofold increase in the likelihood of problems arising during the claims journey - the point at which customers really care about their insurer. The handoff between insurer and third-party provider creates potential blind spots in monitoring customer outcomes, a key requirement of the Consumer Duty.

Insurance purchase and claims flows

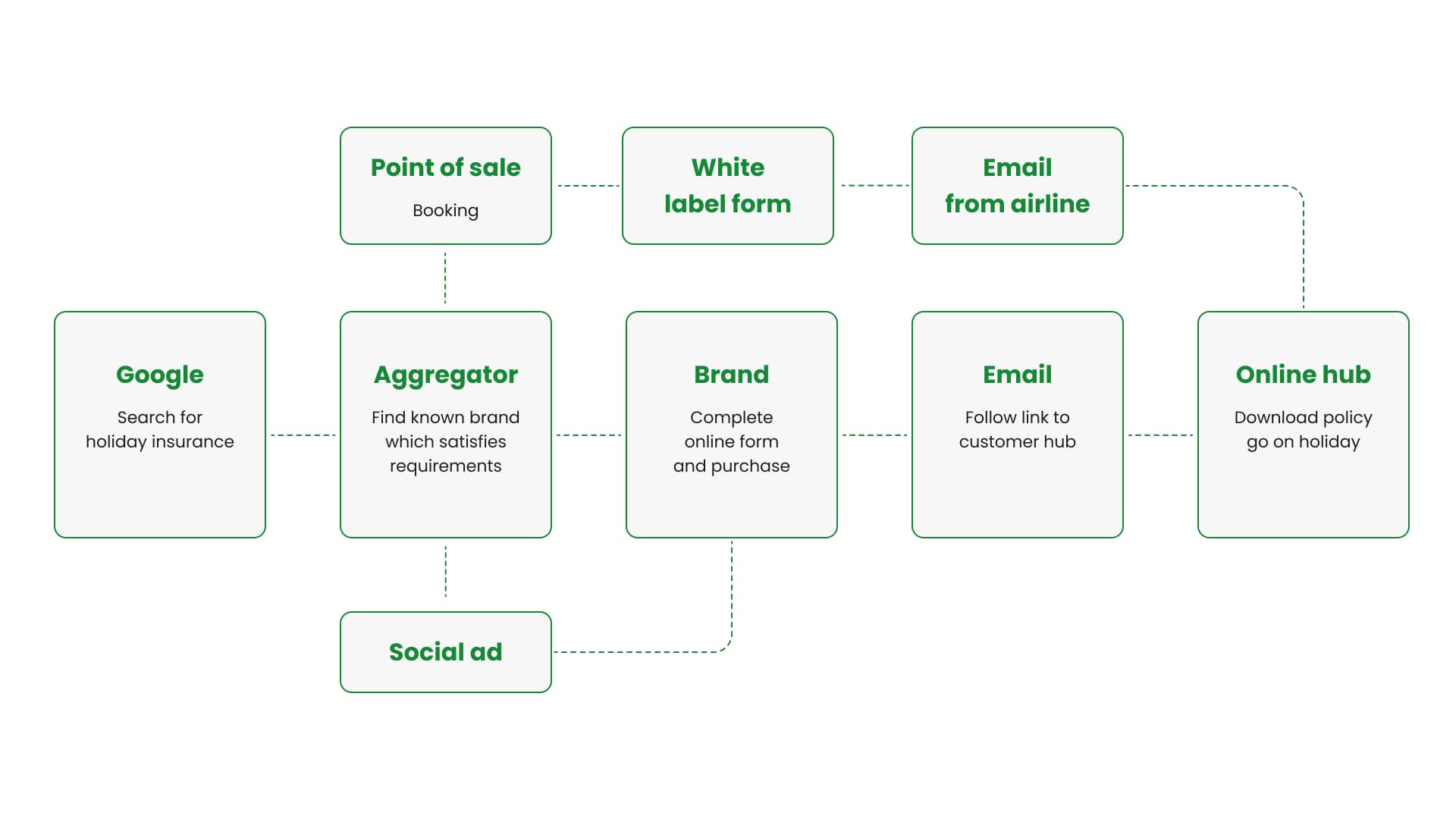

Lets take a travel insurance purchase process and break it down into its flow. Of course, insurance may also be dripped into the process at the point of sale i.e. when booking a flight or even purchasing a car.

The shopping and purchase process is online, largely friction-free and provides all the information required in one convenient place. Great, the customer has what they want, from a provider they recognise, at a price they are comfortable with and they have control throughout.

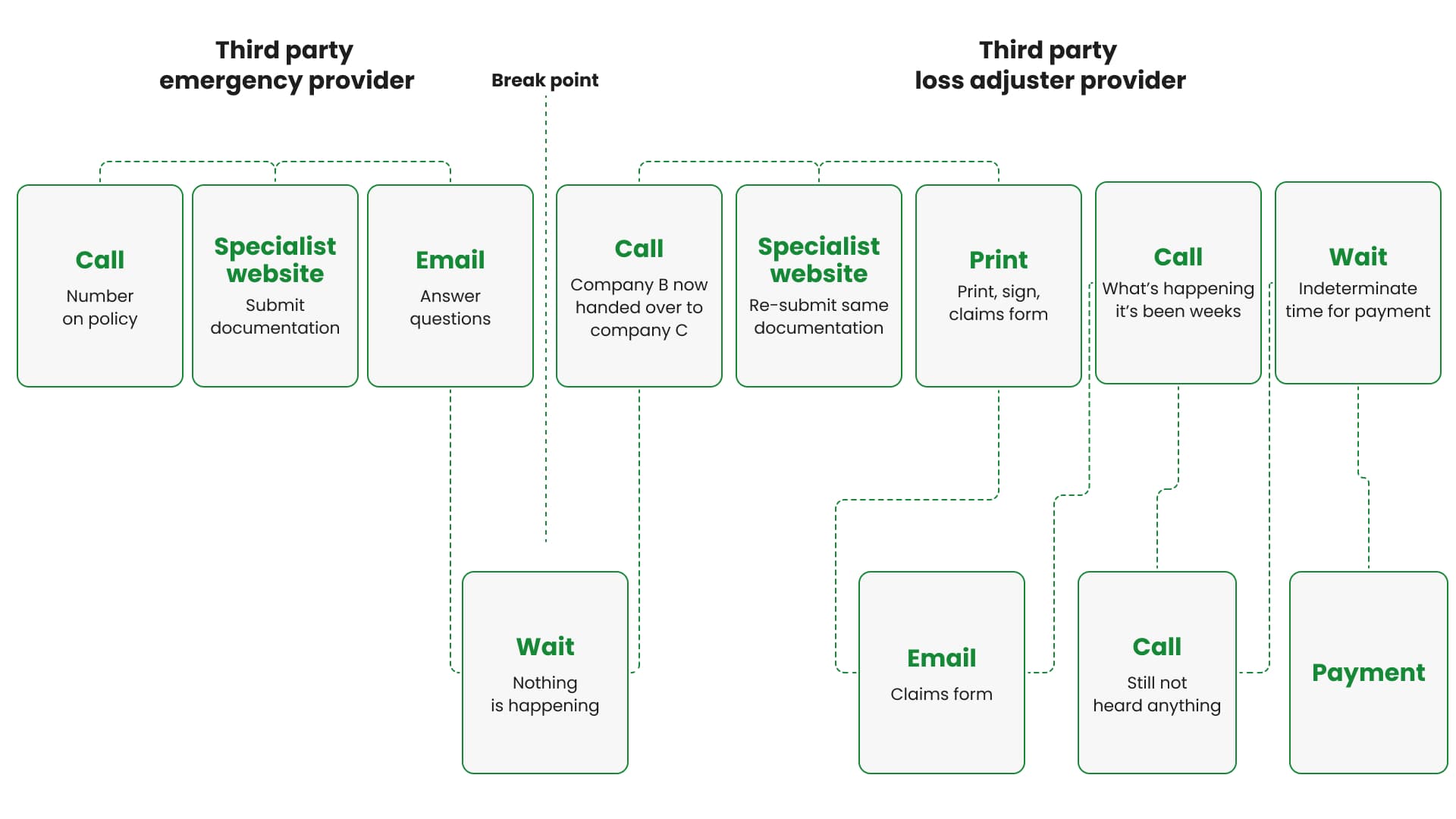

Now let’s look at what happens if this same consumer needs to make a claim, as they have had a fall and require costly medical treatment while on that holiday.

Anyone who has made a holiday insurance claim will probably recognise this process. The customer does not deal with the brand they purchased from but rather specialised services that represent the brand due to the outsourced claims handling. This often results in a lack of control at the moment you need to feel in control. At the point of claim customers face duplicated effort, broken communications and a complex multi-channel interface.

Compliance gaps in insurance

The current structure allows both insurers and third-party providers to claim compliance within their respective domains, while the overall customer experience can fall short of FCA expectations.

Insurers may focus on policy sales and customer acquisition, while third-party handlers concentrate on claims processing efficiency. This siloed approach fails to capture the full customer journey making it more difficult to link back to Consumer Duty.

Ultimately this means consumers are faced with a frustrating experience when they are potentially at their most vulnerable, both psychologically and financially.

Complying to Consumer Duty in insurance: what to do today

Strategic oversight of the entire supply network

Insurers need to form a view of the entire claims process, including all third-party interactions. This will help create a comprehensive understanding of the customer journey and identify potential gaps in compliance.

One of the main challenges highlighted by insurance firms was assessing the fair value of their services, as assessment of current processes focuses on price and value of services not the customer's understanding of them.

Adopting Jobs to be Done - a framework which which helps understand unmet needs and wants - and service blueprint mapping can encourage firms to take a more complete understanding of customer interactions with their products and services. From initial awareness and consideration to purchase, use, and most importantly, post-use support. By considering the entire ecosystem, firms can identify and leverage points where small changes can lead to significant improvements. Improvements that are better aligned to their processes and in line with the FCA's expectation of delivering good outcomes across the product lifecycle, not just at the point of sale.

2. Integrated measurement and compliance tactics

A shift from customer outputs to outcomes means success, and how success is measured, should be redefined and measured across the entire supply network. Firms need to develop integrated measurement systems that span both insurer and third-party operations and handoffs to support compliance. This can take the shape of shared dashboards, regular joint reviews and collaborative KPIs that reflect the entire customer journey.

These measures and the processes supporting them should span clearly defined outcomes, chosen metrics, the identification of poor outcomes, actions taken and the evaluation of results. This kind of evaluation and action is only possible by gathering more comprehensive data across the entire customer journey.

3. Record soft metrics for effectively measuring customer impact

Soft metrics provide insight into the less tangible aspects of customer experience, which are crucial for meeting the FCA's expectations around fair treatment and good outcomes. This means introducing softer metrics and gathering data on them using qualitative and quantitative studies that capture the emotional and psychological impact of the claims process on customers. This could include measures of customer stress levels, clarity of communication, and overall satisfaction with the claims journey

4. Consider a new approach to personas

We suggest creating intelligent personas realtime. They are living, breathing representations of your target customers and their attitudes and needs.

Made from extant data and a continuous flow of information from customer relationship management, online analytics and social listening intelligent personas can be designed and engineered into engaging experiences that can be shared across departments and with partners. This allows employees and partners to prompt, query and ultimately learn from them over time creating awareness and alignment of good outcomes for consumers. Allowing processes and experiences to evolve in a compliant way.

Insurance and complying with Consumer Duty: where to now?

The fractured nature of the insurance claims process presents its own set of challenges when complying with the FCA's Consumer Duty. Insurers must view third-party providers as extensions of their own brand offering seamless and friction-free interactions from beginning to end.

When things go wrong it's the insurer's brand that is damaged, not its partners, therefore, insurers need to own the service delivery end to end and have a clear view of it. Only then will they protect their brand and fully meet regulatory expectations. This includes joint training programs, shared customer service standards and aligned incentive structures.

By creating a more comprehensive understanding of the service flow and customer journey that encompasses the entire supply network, insurers can bridge compliance gaps and deliver the seamless, customer-centric experience that the FCA demands.