Pioneering a remote advice service with Lloyds

We helped Lloyds Banking Group design a service which allows customers to speak with mortgage advisors remotely from the comfort of their own home, or while using an interface in-branch. We worked to define the best possible experience for customers and advisors within the capabilities of current business and technology processes.

The challenge

Expand and improve Lloyds Banking Group service offering to help maintain their place as market leading providers of customer experience.

Revolutionise how people connect with Mortgage advisors by utilising video and telephony technology to deliver advice to home buyers where they need it, when they need it.

Design, develop and test a new service proposition that facilitates remote advice whilst delivering best in class customer experience.

The solution

Understand the customer mortgage journey and concerns about receiving advice via video through qualitative research.

Utilise insight to design a service that supports customers through a potentially complex and emotionally laden mortgage application journey.

Technical analysis to map out current business processes and technical systems to guarantee successful integration and maintenance.

Validating a unique proposition

Remote advice is very different from the typical mortgage process – we knew we had to validate the proposition with users. To do this we used design research methods including customer focus groups, and interviews with Lloyds Banking Group team members, as well as quantitative surveys.

This helped us explore the mortgage application journey, understanding the phases of application and core customer needs at each point of the journey. We then mapped the business and technical processes to this which enabled us to design the ideal remote advisor experience.

Research helped us distil design principles

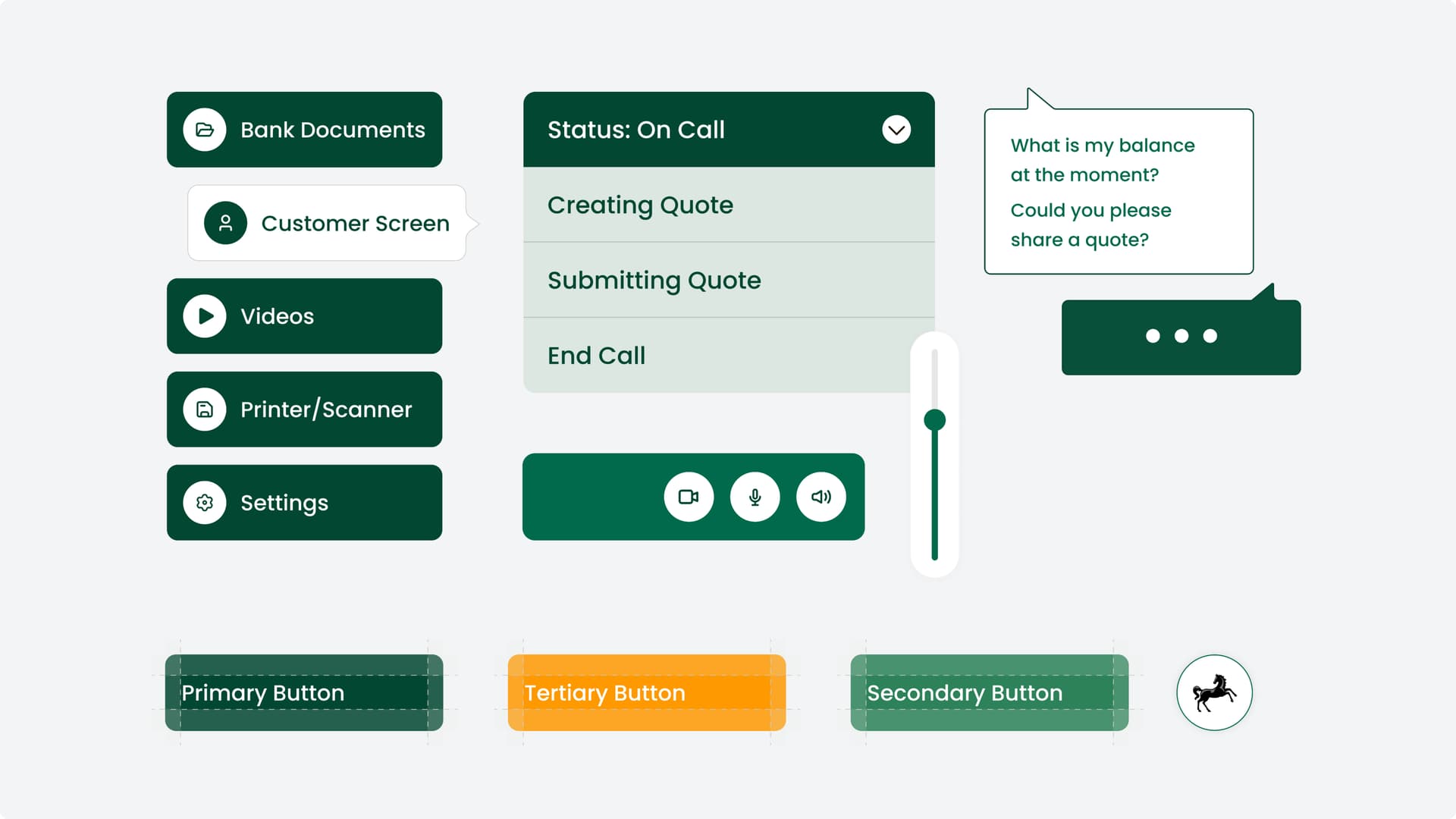

Our design research helped us to understand that lack of confidence was the main barrier to adoption of the service. To address this issue, we held design workshops and created a set of experience design principles which centred on confidence and security. We iterated on our concepts in increasing fidelity by conducting weekly design sprints including validation with customers and advisors to ensure the service would fulfil their needs and meet their expectations.

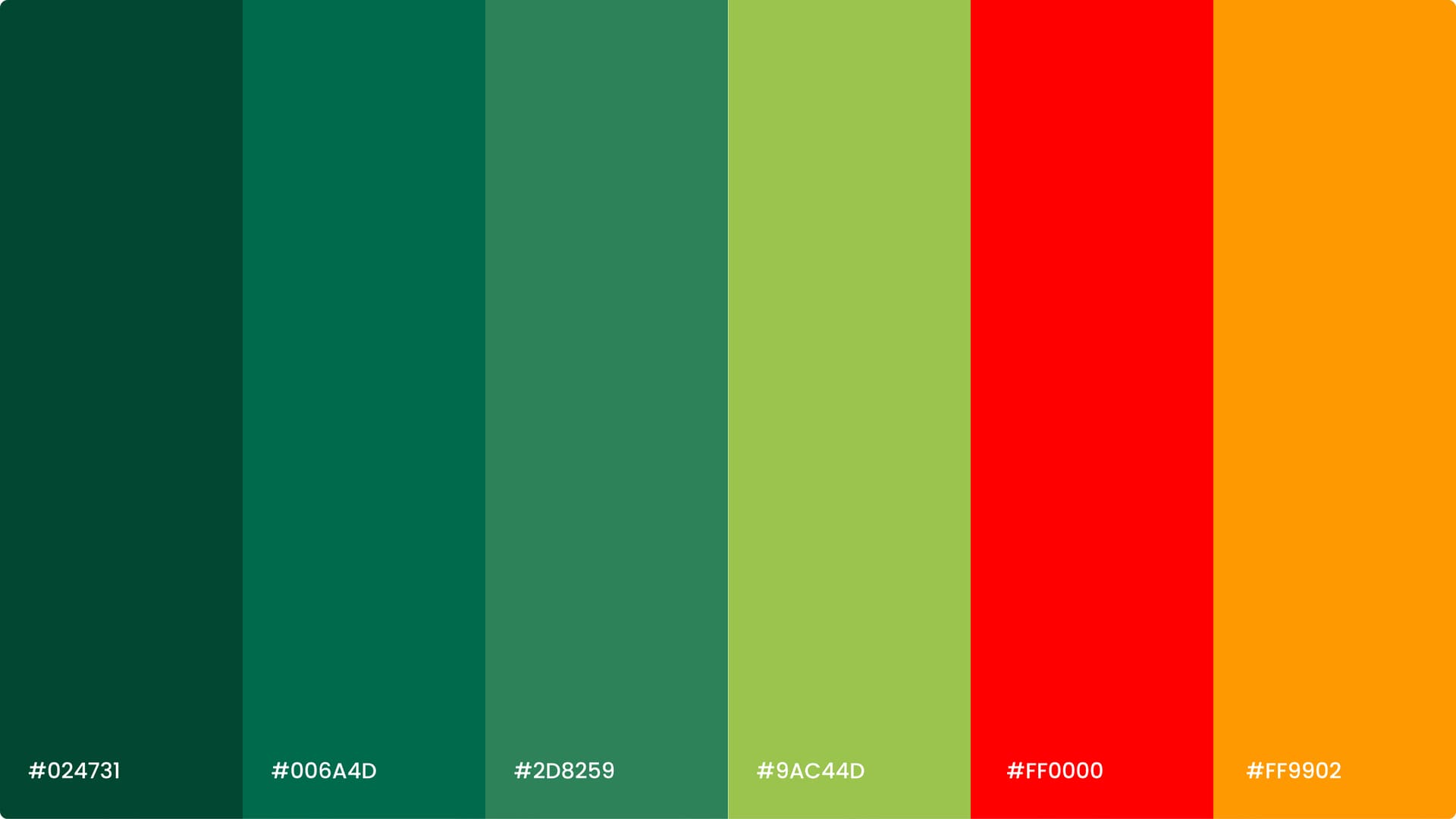

In order to execute the Remote Advice service in accordance with these principles we needed to consider digital and physical details. These included the look and feel of the UI, right down to the appearance of the advisor and the background of the room in which they were sitting. This helped to build trust in the service and Lloyds Banking Group as a brand.

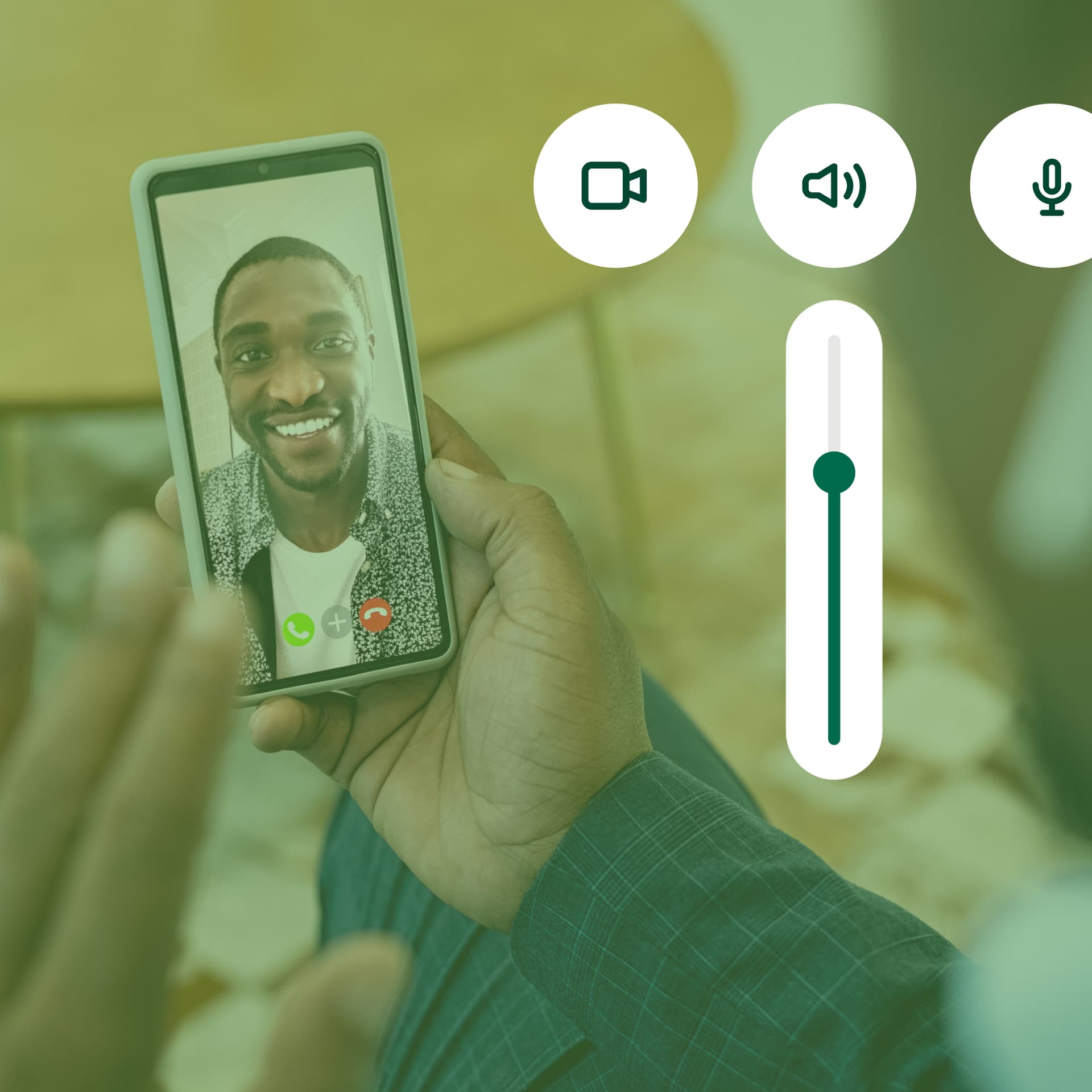

In tandem we validated the technology, this helped to show customers and the Lloyds Banking Group team members that technology enhanced the experience rather than adding friction, giving the end user greater autonomy over their mortgage process.

Understanding all touch points set the course for future change

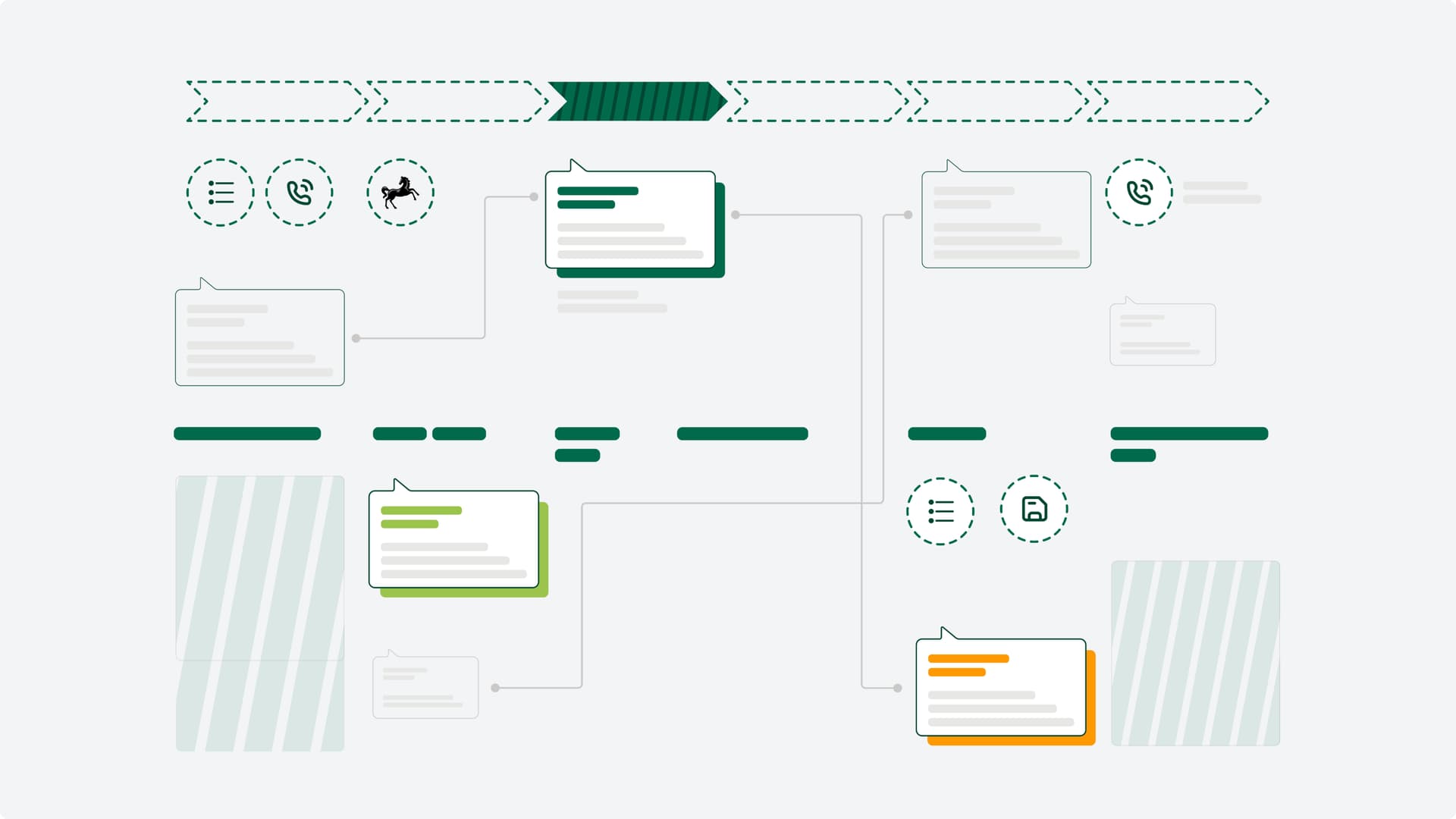

We created a service blueprint for the Remote Advice mortgage journey, highlighting the desired customer actions and outputs at each of the service phases from booking an appointment through to leaving the branch.

This blueprint displays the process and functions above and below the line of visibility to the customer: all touchpoints and the back-stage processes were documented in design and aligned to the overall user experience. This helped our client to evolve the proposition over time and improve the customer journey to ensure it continues to deliver the best possible experience.

Advice whenever, wherever

Our work with Lloyds Banking Group has become the largest branch-based video solution in the UK and one of the big players in Mortgage video provision from home. With 39,000 video interviews in the previous annum at branch or in-home, and the service being available at over 600 branches nationwide. The success of the service has sparked conversations about how we can help Lloyds Banking Group to extend their service vision for expert advice wherever, whenever across their product offering.

Activities

Quantitative research, qualitative research, UI design, service design blueprint, customer journey mapping, stakeholder workshops, technical audit.

Delivery

Weekly agile design sprints.

Contact us

Like what you see?

We'd love to partner with you. Contact Ed, on ed@foolproof.co.uk